- Have any question..?

- 818-208-7909

- [email protected]

Modern Bookkeeping 2

Datarooms India — A Safe and Secure System For Private Document Exchange

May 9, 2023What sort of Boardroom Application Review Will let you Choose the Best Panel Portal

May 14, 2023Modern Bookkeeping 2

Contents:

With the rise of e-commerce, online and instant payments, digital invoicing and rapidly moving global markets, it’s becoming tough to stay ahead and understand where your business sits and work out the best decision to make next. Many businesses are starting to realize that they need to know how a wide range of rapidly changing factors will affect their profits and operating costs in the coming weeks and months. Throw on top trying to manage weekly and bi-weekly payroll, source deductions, benefits and paying back federal loans and it’s understandable why so many small business owners have ended up dissatisfied, anxious and confused. Data collection and categorization is a huge part of any bookkeeper’s day to day.

Fairlawn post office moving Southwest Times – Southwest Times

Fairlawn post office moving Southwest Times.

Posted: Mon, 19 Dec 2022 08:00:00 GMT [source]

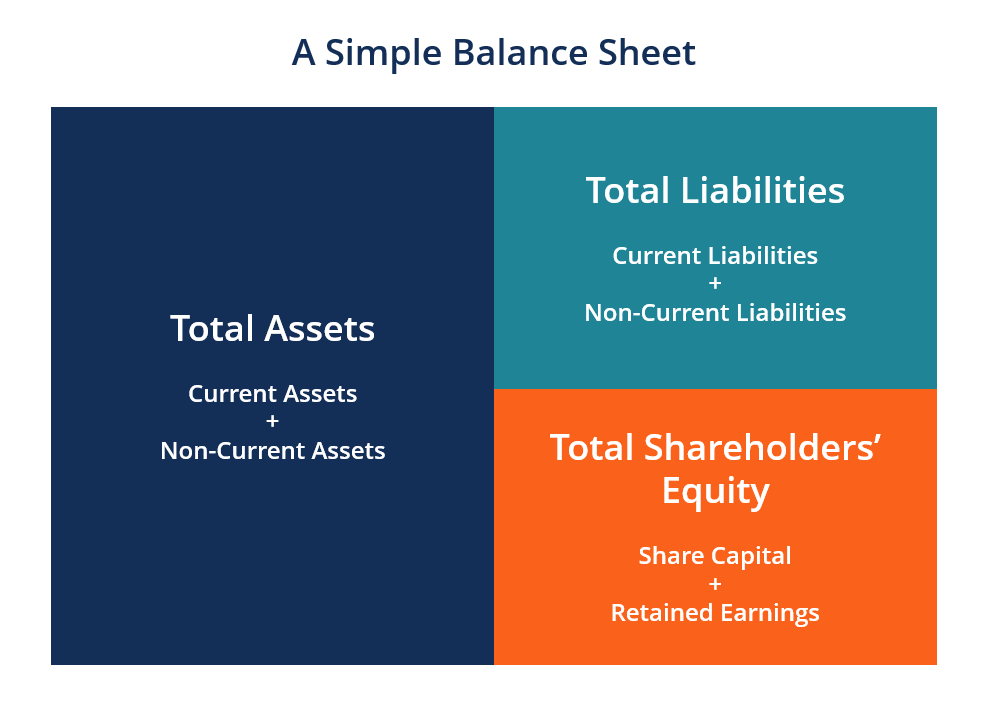

While entering t account is one of the primary responsibilities, the role of a bookkeeper goes beyond that. In practice, the bookkeeping definition or process is much more complicated than simple data-entry. It also extends to gathering data from different sources like business bank accounts and developing basic financial reports such as income statements, balance sheets, cash flow statements, and the like. Furthermore, bookkeeping includes reconciling actual bank account balances with amounts in the general ledger and financial reports like balance sheets and income statements.

Get on the List!

25 This was a culture in which precedence mattered; the only reason why the woman comes first in the title of Venus and Adonis is because she happens to be a goddess. The affront is compounded by the fact that the two books together cost as much as twelve buttons, and considerably less than is spent on the cloth and food. Although Venus and Adonis would prove to be a popular best-seller that helped to make Shakespeare’s name over the course of the 1590s, there is little here to herald that fact. The Shakespeare reference has become, in a sense, the point of the journals, and has even started to shape their material form. While the first and third volumes have been left in a state of advanced decay, the second has been carefully conserved and rebound, partly to render it fit for repeated display.

Bookkeeping first involves recording the details of all of these source documents into multi-column journals . For example, all credit sales are recorded in the sales journal; all cash payments are recorded in the cash payments journal. Most individuals who balance their check-book each month are using such a system, and most personal-finance software follows this approach.

modernbookkeeping.co.za

As it happens, we have good evidence that Stonley’s accounting was as much rhetorical as financial, in the regularity with which his numbers fail to stack up. The first volume contains 51 sums, 12 of which Stonley gets wrong (23.5 per cent). The inventory of Stonley’s Aldersgate Street house lists a plethora of containers in ‘the Galery next the Bedchamber’, including four cases of boxes, one ‘nest of boxes’, seven chests, and ‘A great presse for lettres’. When you add clients to ZipBooks, they’ll receive a celebratory email inviting them to set up their own account. From their self-service dashboard, clients can check the status of their books, message you about any questions, and manage their business.

But when sales and revenue are high and profit is still disappointing as Christmas with Covid, then your Debt may be growing too much too fast. We’ll help your business with a tailored plan to repay your debt and get rid of your profit killers. This website is a great place to be if you are having bookkeeping anxiety and the sounds I+R+S give you hives.

Bookkeeping

LiveFlow is a cloud-based accounting platform that offers all the features you need to manage your finances effectively. By automating key tasks and offering real-time insights, LiveFlow can help you save time and money. By the Middle Ages, accounting had evolved into a more sophisticated practice. Double-entry bookkeeping was developed, and ledgers were used to record financial transactions. A double-entry bookkeeping system is a set of rules for recording financial information in a financial accounting system in which every transaction or event changes at least two different nominal ledger accounts.

- Today, cloud technology also facilitates the outsourcing of an entire accounting department that is completely off-site but still connected to the business on a real time basis.

- Daily records were then transferred to a daybook or account ledger to balance the accounts and to create a permanent journal; then the waste book could be discarded, hence the name.

- The origin of book-keeping is lost in obscurity, but recent research indicates that methods of keeping accounts have existed from the remotest times of human life in cities.

- The affront is compounded by the fact that the two books together cost as much as twelve buttons, and considerably less than is spent on the cloth and food.

- 17 The writer is written by textual practices that they seemed to command — so much for ‘autobiography’.

Botkeeper creates comprehensive financial reports that are just as beautiful to look at as they are informative, and in the format that you want. It may come across as unremarkable but there is magic in the mundane and at the end of the day, bookkeeping is a crucial task for any business. Get started today before this once in a lifetime opportunity expires.

“My Grandfather started our firm in 1951 so clients could have an advocate in their life that cares just as much as they do.”

The live connection between QuickBooks and Google Sheets means that your reports will always be up to date – without any manual exports, data formatting or hands-on effort. Now that we’ve looked at the history of accounting, let’s take a look at modern bookkeeping. Because ‘Modern’ bookkeeping is billed through monthly ‘plans’, you can typically cancel your ‘plan’ at any time, for free, if you’re unhappy with the service provided. Monthly billing also allows you to change ‘plans’ to match your current business requirements, meaning you’re not left paying for low value or irrelevant services you don’t need or want.

Mapping the modern CFO stack Ctech – CTech

Mapping the modern CFO stack Ctech.

Posted: Mon, 28 Nov 2022 08:00:00 GMT [source]

Thereafter, an accountant can create financial reports from the information recorded by the bookkeeper. The bookkeeper brings the books to the trial balance stage, from which an accountant may prepare financial reports for the organisation, such as the income statement and balance sheet. Bookkeeping is the recording of financial transactions, and is part of the process of accounting in business and other organizations. It involves preparing source documents for all transactions, operations, and other events of a business. Transactions include purchases, sales, receipts and payments by an individual person or an organization/corporation. There are several standard methods of bookkeeping, including the single-entry and double-entry bookkeeping systems.

Your business numbers, directly calculated from your constantly reconciled accounts, are presented in a free, easy-to-understand, on-demand, shareable dashboard – and like your billing, it can be managed online whenever you find it convenient. Offering the most cost effective small business managed payroll services in Canada, we also provide specialized discounts for startups and new businesses, along with dedicated solutions for franchises. Many small businesses are transitioning to ‘Modern’ bookkeeping services after finding the ‘Traditional’ bookkeeping approach doesn’t fit their business needs.

Botkeeper, for example, provides bookkeeping software that is tailored to meet your organization’s needs, so you don’t have to worry about training and monitoring your staff to do it your way. Rapid advances in technology, especially artificial intelligence, have made it possible for computers to undertake human tasks and do them with more accuracy and within seconds! At Botkeeper, the emphasis lies in maximizing the benefits of artificial intelligence so that the bookkeeping is entirely automated.

An accounting firm can help you avoid paying penalties or filing an amendment or an extension. By ensuring that you get all the credits you qualify for, you can be at ease. Always choose an accounting firm that has experience with your tax situation. Taxes are complicated, so much that you will find CPAs who serve in their specific niche. For example, if you are in estate planning, you can find CPAs that have extensive experience in it and know all the issues that are related to compliance.

The quest to find reliable, professional and trustworthy bookkeeping service can be a challenge for a business owner. After all, you are placing a lot of financial responsibility in the bookkeeper’s hands, responsibility that can affect your personal and business future. We understand the challenges that you face when you are working on business financial systems.

As a partial check that the posting process was done correctly, a working document called an unadjusted trial balance is created. Column One contains the names of those accounts in the ledger which have a non-zero balance. If an account has a debit balance, the balance amount is copied into Column Two ; if an account has a credit balance, the amount is copied into Column Three . The debit column is then totalled, and then the credit column is totalled.